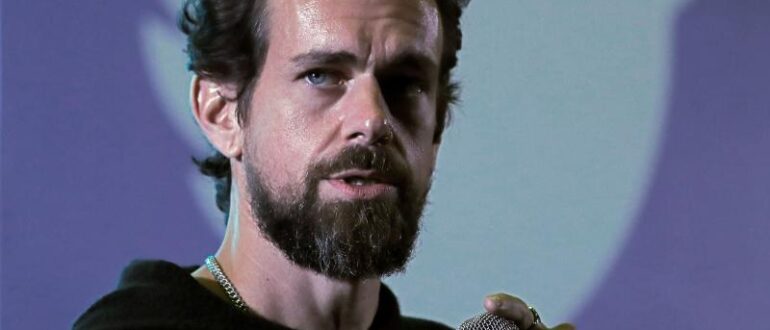

Twitter CEO Jack Dorsey is stepping down as chief of the social media company, effective immediately. Parag Agrawal, the company’s chief technology officer, will take over the helm. Shares of both Twitter and Square were up with the news. Scott Galloway has been calling for this one for a while – there you go Scott! #wakeupimagine https://www.cnbc.com/2021/11/29/twitter-ceo-jack-dorsey-is-expected-to-step-down-sources-say.html?__source=sharebar|linkedin&par=sharebar

Category Archive for: Capital Markets

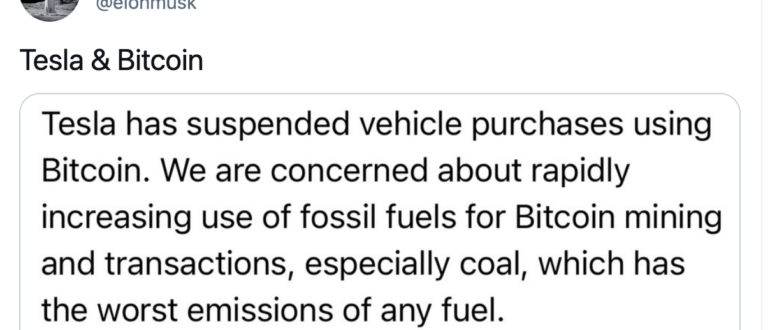

Elon Musk, who has become a volatile force in the #cryptocurrency universe, said Tesla is no longer accepting Bitcoin Inc. as payment for purchases of its #electricvehicles owing to the excessive amount of carbon-based energy it uses. Bitcoin plunged following his comments. The sudden move is a curious one since Tesla’s recent $1.5 billion Bitcoin investment triggered a surge in the currency’s value. It also…

E L O N x S N L – Okay quick, when was the last time you were talking about who was hosting Saturday Night Live two weeks ahead of the show? In a Musk-Tune-In event (sorry couldn’t resist) tonight the King of Crypto himself hosts. The big winner – SNL – as this may…

Yes, big tech continues to grow at exponential rates, and the acronym we all know and love(?) shifts letters as our jaws sit agape at the latest quarterly results. For the uninitiated, that acronym is collectively worth $8T+: $FB, Facebook ($923.6B)$AAPL, Apple ($2.2T)$AMZN, Amazon ($1.7T)$MSFT, Microsoft ($1.9T)$GOOGL, Alphabet Inc. ($1.6T) The #pandemic boosted sales – big time! The phrase “record growth” was a constant theme for Q1…

Michael Katchen just announced another big win for Canada. Wealthsimple has received the largest private tech investment in Canadian history. Meritech Capital and Greylock, two of the world’s premier #tech investors, are leading a $750 million investment round to help Wealthsimple do what we always believed it could: revolutionize the way we do money, and become the biggest consumer finance company in…